capital gains tax proposal washington state

On March 6 a bill to tax capital gains passed the Washington state senate. The new tax would affect an estimated 58000.

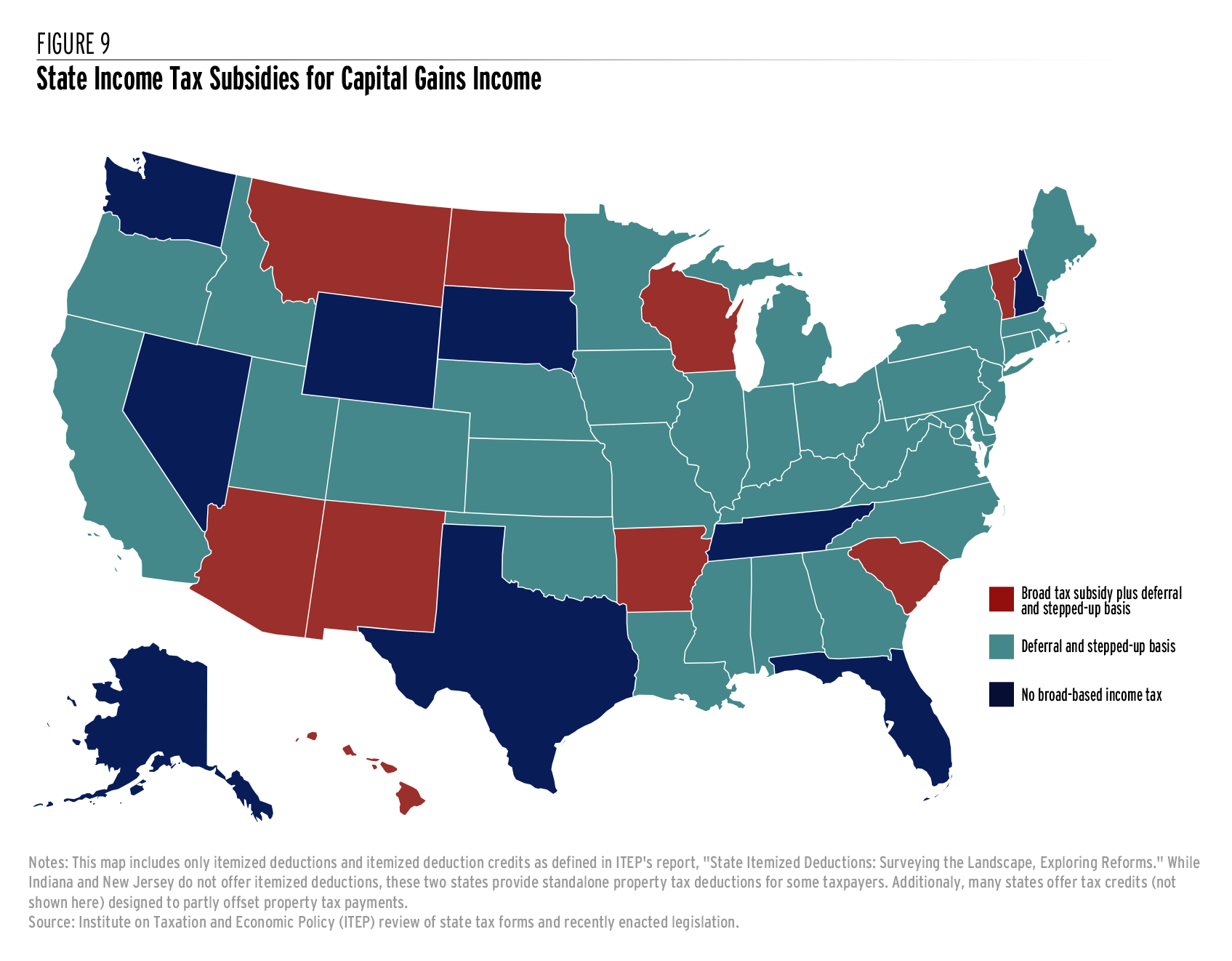

Income Tax Increases In The President S American Families Plan Itep

No capital gains tax currently exists in Washington at the state or local level.

. This is not the great recession - WA revenues still growing every year. To see what Gov. A warning from France on wealth taxes.

The state would apply a 9 percent tax to capital gains earnings above 25000 for individuals and 50000 for joint filers. Exempt from the proposed Washington capital gains tax. Select Popular Legal Forms Packages of Any Category.

Description This proposal would tax individuals for the sale or exchange of capital assets they have held for more than one year unless an exemption applies. The state would apply a 9 percent tax to capital gains earnings above 25000 for individuals and 50000 for joint filers. Retirement accounts homes farms and forestry are exempt.

This proposal impacts approximately 58000 taxpayers and will impact the state general fund in the following ways. Effective budgeting requires revenues to be predictable and relatively stable. Posted in Policy and Legislation State Domicile and Residency.

Although the tax was effective as of January 1 2022 the first tax returns werent actually due until the due date of the 2022 federal income tax return. This proposal is effective January 1 2022 with the first capital gains tax return due April 15 2023. If theyre 250050 you incur a 7 state tax on that extra 50.

Per-Capita Inflation adjusted state spending has more than doubled since 1970s. State of Washington that the capital gains excise tax ESSB 5096 does not meet state constitutional requirements and therefore is unconstitutional and invalid. The new law will take effect January 1 2022.

Inslee proposed in his 2021-23 budget see Gov. The bill is part of a multi-year push by the legislature to rebalance a state tax system that it calls the most regressive in the nation in. The Washington State Supreme Court today expedited the ultimate resolution of the Freedom Foundations lawsuit challenging the capital gains income tax bill passed by the Legislature in 2021 by announcing it will accept direct review of the case effectively allowing the matter to bypass the court of appeals.

New state tax proposals examined by Jason Mercie r. How much will the state collect under the tax. 5096 introduced on Jan.

For example if your annual gains are 249999 no additional tax is incurred. 5096 which was signed by Governor Inslee on May 4 2021. Of course all the states Office of Financial Management can do is assume that capital gains will increase every year whereas in practice capital gains are exceedingly volatile.

Proposed changes to federal and state taxes on estates gifts and wealth if enacted can have a. The new tax would affect an estimated 42000 taxpayers about 15 percent of households in the first year. Under the unusual dynamics of the COVID-19.

6 by state senators Hunt Robinson and Wilson Nguyen would impose an excise tax equal to seven percent of a Washington residents capital gains starting January 1 2022. It taxes out-of-state earnings and out-of-state activity. If we accept the states argument that its an excise tax then its probably an unconstitutional one because it fails to meet the nexus requirements established in cases like Complete Auto Transit.

Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. Continue Reading Governor Dusts Off Washington Capital Gains Tax Idea Proposes. The future of Washingtons capital gains tax is in the hands of Washington State Supreme Court.

Governor Inslee is proposing a capital gains tax on the sale of stocks bonds and other assets to increase the share of state taxes paid by Washingtons wealthiest taxpayers. Timber A taxpayer who sells or cuts timber and elects to treat the activity as a capital gain for federal tax purposes under Section 631a or b of the Internal Revenue Code is exempt from the proposed Washington capital gains tax. Senate Bill 5096 levies a 7 tax on Washington residents annual long-term capital gains exceeding 250000.

Washington has long benefited from its status as one. SB 5096 would impose a 9 income tax on capital gains in Washington state. The measure would impose a 7 capital gains tax on individuals and couples who make in excess of 250000 on sales of stocks and bonds.

Barring any legal challenges the new tax kicks in beginning January 1 2022. The realization of capital gains slid 71 percent between 2007 and 2009 55 percent in 1987 and 46 percent in 2001. While the appeal is pending the Department will continue to provide guidance to the public regarding the tax as a.

Separately the Democratic governor also released proposed capital construction and transportation budgets. Retirement accounts all property sales farms and forestry. Washingtons capital gains tax is designed as a direct tax not an indirect one.

This information relates to a capital gains tax as proposed in 2018. All Major Categories Covered. Inslees 21-23 capital gains tax proposal QA.

All projections err to some degree and no revenue sources are immune to economic conditions but what Washington State is consideringultimately relying on capital gains taxes for 13 billion in tax revenue per bienniumcould leave the state in a serious bind. When July 8 passed last week so did the deadline for filing signatures on the more than three. Washingtons new state capital gains tax was ruled unconstitutional on March 1 2022.

Washingtons legislature passed a new capital gains tax in April Engrossed Substitute SB. The proposal will raise an estimated 975 million. The State has appealed the ruling to the Washington Supreme Court.

The tax measures are contained in the governors two-year 576 billion operating budget proposal released Thursday in advance of the 2021 Legislative session.

Washington State Enacted Capital Gains Tax Currently Held To Be Unconstitutional 2021 Articles Resources Cla Cliftonlarsonallen

How Might The Taxation Of Capital Gains Be Improved Tax Policy Center

Does Your State Have A Gross Receipts Tax State Gross Receipts Taxes

How Do State And Local Sales Taxes Work Tax Policy Center

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Potential Changes To The Capital Gains Tax Rate Publications Foley Lardner Llp

How Do State And Local Individual Income Taxes Work Tax Policy Center

Billionaires Tax On Capital Gains Invites Tax Collection Volatility

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Billionaires Tax On Capital Gains Invites Tax Collection Volatility

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

Taxing Wealth By Taxing Investment Income An Introduction To Mark To Market Taxation Equitable Growth

2.png)

How High Are Capital Gains Tax Rates In Your State Tax Foundation

3 Ways Colorado Could Tax Wealth Colorado Fiscal Institute

The Billionaires Income Tax Is The Latest Proposal To Reform How We Tax Capital Gains Itep

How High Are Capital Gains Taxes In Your State Tax Foundation

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation

Navigating Washington State S New Capital Gains Tax Coldstream Wealth Management

Taxing Wealth By Taxing Investment Income An Introduction To Mark To Market Taxation Equitable Growth